Many Americans are surprised to learn just how much more CEOs make compared to average workers. During a recent Strawberry Festival in Ohio, people guessed that CEOs earn about three times more than their employees. The truth, however, is much more shocking. For instance, the CEO of McDonald’s earned 1,212 times more than his average employee last year, while Lowe’s CEO made 557 times more than typical workers. This huge gap in earnings highlights a big change in American workplaces.

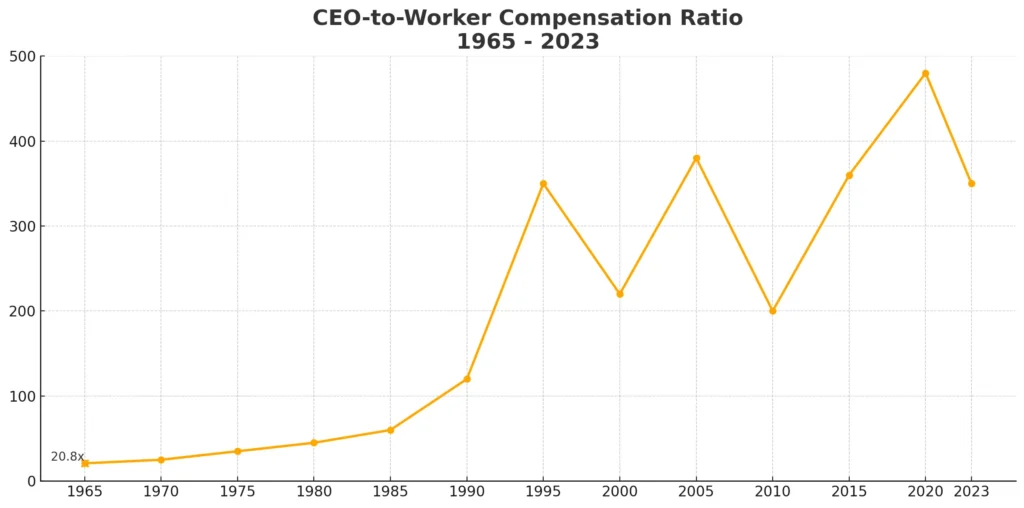

Back in the mid-1960s, CEOs made about 20 times what their employees earned. Today, that number has skyrocketed to 290 times more, which many experts say reflects a troubling pattern of wealth moving from regular workers to top executives and investors.

The Human Impact of Corporate Decisions

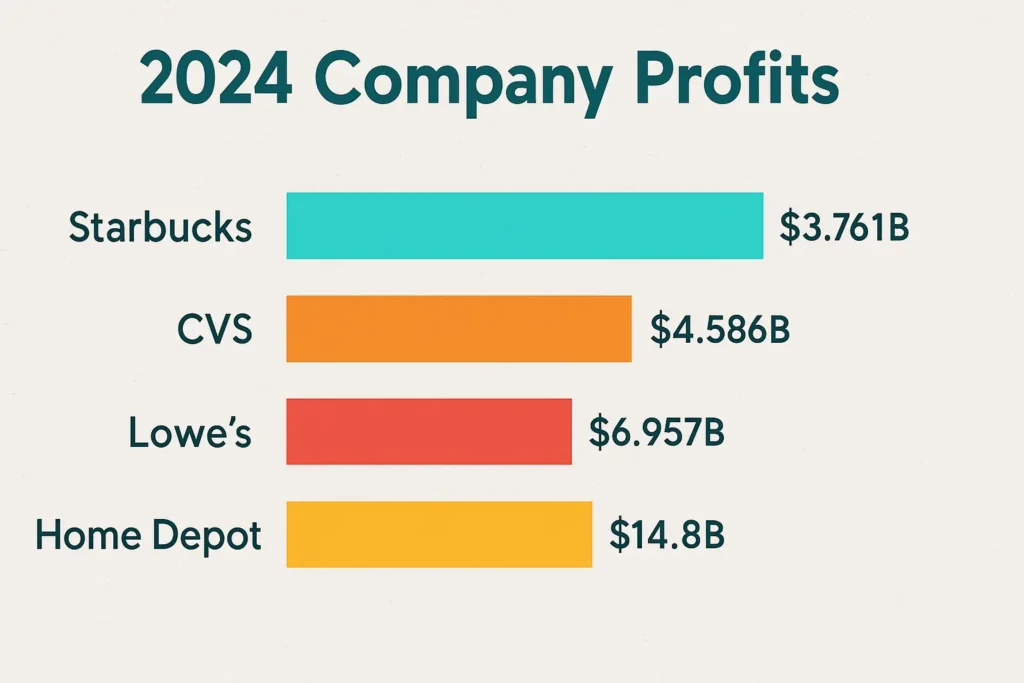

Felix Allen, a former employee at Lowe’s in New Orleans, felt this inequality firsthand. He started working there at just $12 an hour, and some long-time employees at his store have been earning less than $15 an hour for years. Allen’s experience is not unique; many workers at Lowe’s earn around $33,000 a year.

Despite the companies doing well financially, many report being understaffed, leading to stressful working conditions. “There were often too many customers and not enough workers in red vests,” Allen said. “It’s stressful. It takes a toll on you.”

The Rise of Shareholder Interests

The shift in how companies operate began in 1979 when businesses like Lowe’s became publicly traded. Companies then had a few options for how to use their profits: they could reinvest in their operations, pay dividends to shareholders, or invest in their employees through training and better wages. This balanced approach was typical back when companies prioritized innovation and supported strong unions that ensured fair pay for workers.

However, the 1980s brought a new philosophy, often referred to as “shareholder primacy.” According to Lenore Palladino, a researcher on corporate governance, this idea focused solely on making money for shareholders, often at the expense of workers.

The Shift in CEO Compensation

This focus on shareholders led to a change in how CEOs are paid. Instead of traditional salaries, many companies started giving CEOs compensation that included stocks. This quickly caught on across the business world, as CEOs wanted to keep up with each other’s pay increases. “If one CEO starts being paid differently and earns more, that trend spreads quickly,” Palladino explained.

This new way of paying CEOs encouraged them to focus on raising stock prices rather than investing in their companies or their employees.

The Introduction of Stock Buybacks

A major change happened in 1982 when companies got the green light to buy back their own stock. Stock buybacks can increase the value of shares, making them a tool for business manipulation. Historically, this practice was considered illegal because it could be seen as cheating the market. But under President Ronald Reagan’s deregulatory policies, the ban was lifted. This decision allowed businesses to enrich their executives and shareholders without improving how the company operated.

Sarah Anderson, an expert on corporate pay, explained that this decision essentially let companies pay their top executives more without having to enhance their actual performance.

A Flawed System of Incentives

The combination of stock-based pay and the legalization of buybacks created a situation where CEOs can boost their earnings without necessarily making their companies better. Today, around 80% of a CEO’s pay can come from their company’s stock, with big bonuses tied to stock performance. When companies make large profits, CEOs are faced with a choice: should they invest in their employees and improve customer service, or buy back stock to increase their own compensation? This creates a powerful incentive for many executives to prioritize their own pay over the well-being of their workforce.

Also Read –

Mel B Marries Hairstylist Rory McPhee at St. Paul’s Cathedral – said “I do” in style!