The Senate is planning to discuss a huge piece of legislation from President Donald Trump and congressional Republicans this Saturday. Supporters refer to it as the “One Big Beautiful Bill Act.” They will use a special process called budget reconciliation, which allows them to move forward without being blocked by Democratic votes.

In May, the House of Representatives passed a significant bill by a small margin, which is now headed to the Senate. This bill aims to continue the tax cuts originally put in place during Donald Trump’s presidency, provide more funding for border security, and make big changes to social welfare programs. It reflects the Republicans’ intention to swiftly undo many of President Joe Biden’s achievements and strengthen Trump’s legacy in various policy areas.

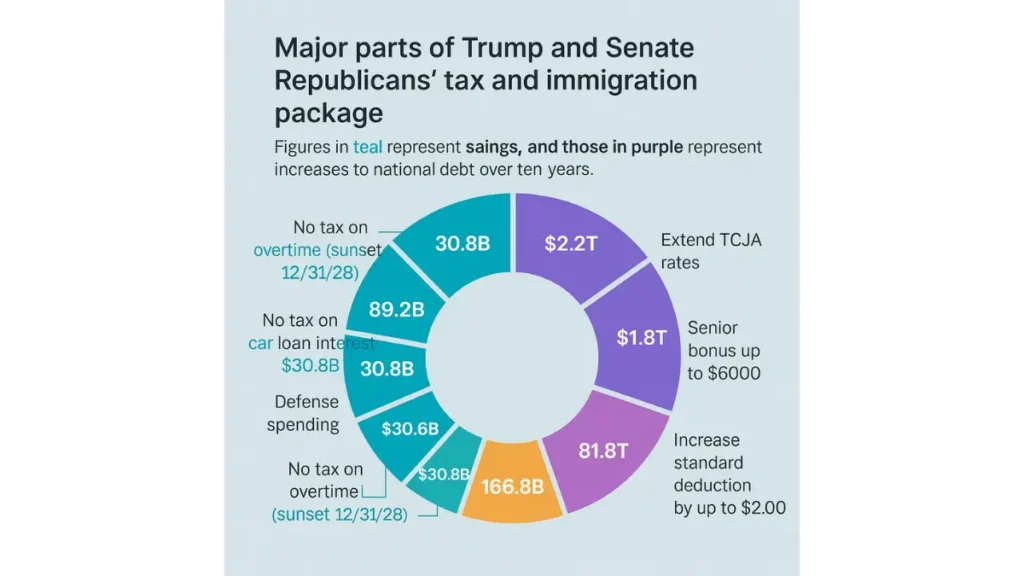

Major Tax Provisions

Extension of 2017 Trump Tax Cuts

The new law aims to keep the lower tax rates that were put in place by Trump’s 2017 tax reform. These lower rates are scheduled to end soon, which means that without action from Congress, many families will have to pay higher taxes. The 2017 tax changes reduced taxes for people with a wide range of incomes, but most of the benefits went to the richest individuals and corporations.

Increased Standard Deduction

The new bill aims to keep and raise the doubled standard deduction that was introduced in the Tax Cuts and Jobs Act. This means that married couples filing together could see their deduction increase by as much as $2,000, bringing their total to $32,000. For individuals filing on their own, the deduction could go up by $1,000, reaching a total of $16,000.

Enhanced Child Tax Credit – With Restrictions

The child tax credit is set to go up from $2,000 to $2,200 for each child, and in the future, it will increase with inflation. However, only parents or guardians who have Social Security numbers can qualify for this credit. This means that only citizens or legal immigrants who have valid Social Security numbers will be able to claim the credit. As a result, parents who are not citizens won’t be able to get this credit for their child if that child is a citizen.

Limited SALT Deduction Relief

The bill quadruples the cap on the state and local tax (SALT) deduction from $10,000, allowing filers to write off more local taxes from their federal tax bill. However, the increase would only last five years before returning to the $10,000 cap.

Trump Campaign Promise Fulfillment

No Tax on Tips

The new law would let workers in certain industries deduct all their tip income from their taxes, which was a significant promise made during Trump’s campaign. To ensure fairness, the law has rules in place to stop highly-paid employees from falsely claiming their regular earnings as tips. The professions that can benefit from this include those in food service, hair and nail care, beauty treatments, and spa services.

No Tax on Overtime

One of Trump’s campaign promises includes a new plan to make overtime pay tax-free by introducing a special deduction. However, this new rule requires people to have a Social Security number to take advantage of this deduction, meaning that most undocumented immigrants won’t be able to use it.

American Car Loan Interest Deduction

People who buy American-made cars can save money on their taxes by deducting up to $10,000 from the interest they pay on car loans for four years. However, if a single person earns more than $100,000, or a married couple makes more than $200,000 together, the amount they can deduct will gradually decrease.

Senior Tax Relief

Trump had pledged to eliminate taxes on Social Security benefits, but the new plan actually raises the standard deduction by an additional $6,000 for those aged 65 and older. However, this benefit gradually decreases for individuals who earn more money.

Border Security and Immigration

Massive Border Security Investment

The Congressional Budget Office reports that the Senate’s plan includes almost $170 billion aimed at the Trump administration’s efforts on border security and immigration control. Out of this amount, over $46 billion is set aside to build the wall along the U.S.-Mexico border and to strengthen other security measures, including at ports. Additionally, more than $70 billion would be used to create and manage detention centers where families of people being deported can be housed and transported.

Social Safety Net Changes

Deep Medicaid Cuts

In order to manage their budget, Republicans are planning significant cuts and new rules for Medicaid, which is the health insurance program for people with low incomes and those with disabilities. The Senate is introducing requirements for people to work in order to qualify for benefits and is changing how costs are shared. They are also putting limits on the taxes that states can use to get more federal funding for Medicaid.

Rural Hospital Bailout Fund

The Senate has set up a $25 billion fund to help support rural hospitals and health clinics. This fund aims to ease the impact of new tax limits on healthcare providers. It will start in 2028 when the new tax rules come into effect and will end in 2032.

SNAP Program Changes

The new law will limit how much the SNAP program, which helps people afford food, can grow in the future. Starting in 2027, the federal government will cover only 25% of the costs to run the program, instead of splitting the costs equally with state governments like it does now. Additionally, states that have higher rates of mistakes in their payment processing may have to pay up to 15% of the costs for benefits given to people.

Education and Innovation

New College Endowment Taxes

The new law imposes higher taxes on the money that colleges and universities make from their endowments, which are funds set aside for investment. This system is designed to charge different tax rates depending on how much money the school has in its endowment compared to the number of students enrolled:

- More than $500,000 but less than $750,000: 1.4 percent tax rate

- More than $750,000 but less than $2 million: 4 percent tax rate

- $2 million or more: 8 percent tax rate

Student Loan Program Repeal

A new law could save $320 billion over the next decade by canceling the student loan forgiveness program from the Biden administration and making some adjustments to how loan repayments work.

Private School and Homeschooling Tax Credits

The bill proposes to offer up to $4 billion each year in tax breaks for people who donate to groups that help families afford private school or homeschooling. This means that if you give money to organizations that provide scholarships, you can get a full tax credit for your donation.

Defense and Infrastructure

Major Defense Spending

The Defense Department’s budget is about $158 billion. This money includes $25 billion for weapons and supplies, $329 billion for building ships, and $34 billion for missile defense and space projects. A portion of this budget supports a missile defense system called the “Golden Dome,” which was introduced during Trump’s administration to protect the country.

Federal Land Sales for Housing

A new proposal is being made that would ask the Bureau of Land Management to sell off part of its land—between 25% and 50%—to help build new homes. However, this plan would not include land that is designated as national parks, monuments, recreational areas, wilderness areas, or land used for grazing under contracts.

Spectrum Auction Authority

The new law would give the Federal Communications Commission (FCC) the power to sell radio frequencies needed for things like cell phone service and internet connections. The Commerce, Science, and Transportation Committee believes this could generate $85 billion over the next decade.

Energy and Environmental Policy

Climate Change Investment Rollback

The proposal aims to significantly weaken key parts of President Biden’s 2022 climate legislation, known as the Inflation Reduction Act. Republicans want to remove the federal tax credit that currently gives people up to $7,500 off the purchase of electric vehicles. They also plan to quickly cut back on the financial incentives that encourage the production of clean energy sources like wind and solar power.

Expanded Fossil Fuel Production

The Natural Resources Committee is pushing for quick approval of oil and gas drilling in the Gulf of Mexico and in protected areas of Alaska. The proposed legislation would also require the Interior Department to increase coal production and ease the rules around getting coal from the ground.

Additional Provisions

Trump Savings Accounts for Newborns

A new plan suggests that every newborn baby would receive a special savings account called a “Trump account,” starting with $1,000. Parents or other guardians would be able to add up to $5,000 each year to this account until the child turns 31. This idea is similar to a proposal from Senator Cory Booker of New Jersey, which encourages saving for children’s future by providing “baby bonds.”

Federal Worker Protections

The new law will require a review of the family members of federal employees who are covered by government health insurance plans. Earlier drafts of the legislation included more changes for the federal workforce, but those parts were taken out.

Debt Ceiling Increase

The Senate is proposing a bill to increase the government’s borrowing limit by $5 trillion. Although the government actually went over the current borrowing cap at the end of 2024, Treasury Secretary Scott Bessent has taken special steps to manage the situation and avoid needing to borrow money right away. However, these temporary solutions will run out sometime in August.

Political Process and Timeline

Republicans are working to get a new measure approved using a special process called budget reconciliation. This method enables them to avoid a Democratic filibuster in the Senate, allowing them to pass the bill with only their party’s support. However, discussions about the bill are still ongoing, and changes made by the Senate have altered the legislation significantly, leaving some House lawmakers feeling confused about what it originally included.

Trump and Senate leaders are hoping that the House will agree to some proposed changes, even though there are worries about important topics like social programs and the national debt. The Senate is planning to discuss the One Big Beautiful Bill Act this Saturday, which is an important move for Republicans as they work to quickly push forward Trump’s legislative goals.